GenAI for Auditors & CPAs: Automating Year-End Audits with AI

Accounting and audit processes have never been fully automated. For decades, Certified Public Accountants (CPAs) have relied on manual reviews, spreadsheets, sampling techniques, and endless email exchanges with clients. While these methods have long been accepted as “part of the job,” they place a heavy burden on audit teams especially during year-end.

Instead of focusing on what truly matters — professional judgment, risk assessment, and audit review — auditors often find themselves buried under administrative work. Before any meaningful analysis can begin, they must first collect, sort, rename, classify, and structure thousands of client documents. Invoices arrive mixed with receipts, bank statements are incomplete or duplicated, and supporting evidence is scattered across emails, shared drives, and multiple formats.

This manual document handling consumes an enormous amount of time and energy. It delays audits, increases the risk of human error, and shifts auditors’ attention away from review and assurance toward low-value operational tasks.

With the rise of Generative AI (GenAI), this reality is changing — fast.

Year-end audits no longer have to mean weeks of document chaos, late nights, and manual reconciliations. GenAI fundamentally redefines how auditors collect, organize, analyze, and validate financial data. Instead of spending days structuring files, auditors start with clean, organized, and audit-ready documentation. Instead of manually searching for inconsistencies, they can ask direct questions and receive instant, explainable insights.

By removing the burden of document sorting and structuring, GenAI allows CPAs to return their focus to where it belongs: review, compliance, risk identification, and informed decision-making. Traditional audit pain points are transformed into streamlined, intelligent workflows, enabling faster audits, higher quality assurance, and more confident outcomes.

The Year-End Audit Reality: A Document Nightmare

Every CPA knows the scenario — and dreads it. As year end approaches, clients begin sending huge volumes of documents, often coming from multiple departments, systems, and individuals. What arrives is rarely structured, complete, or consistent. Instead of a clean audit package, auditors receive a fragmented mix of invoices, receipts, bank statements, expense reports, contracts, and supporting evidence — delivered through emails, shared drives, exports from ERP systems, and ad-hoc file uploads.

While all of this information is essential for audit assurance, it almost never arrives in an audit-ready state.

The core challenge is not the availability of data, but the absence of structure. Documents are frequently unlabeled or incorrectly named, duplicates are common, formats vary widely, and key information is often missing or inconsistent. Financial evidence is spread across PDFs, scans, images, and spreadsheets, making it difficult to establish a reliable starting point for review.

Before any meaningful audit analysis can even begin, auditors must first invest significant time in manual preparation. Files need to be sorted, document types identified, folders reorganized, and completeness verified. This preparatory work is unavoidable — yet it adds no audit value and consumes a disproportionate amount of time from skilled professionals.

This phase alone can take days or even weeks, delaying audit reviews, increasing pressure on teams, and pushing critical analysis and judgment to the very end of the engagement timeline.

This is the reality of year-end audits today — and it is exactly the problem that Generative AI is now changing.

Challenge #1: Unstructured, Unorganized Client Documents

Manual document handling is one of the largest hidden costs in auditing.

Sorting documents into folders, identifying what each file represents, and verifying whether all required evidence has been received is pure overhead. While necessary, it adds no audit value and consumes some of the most expensive time in an audit engagement. This work pulls auditors away from review and professional judgment, increases the risk of human error, and scales poorly as document volumes grow.

How elDoc solves it

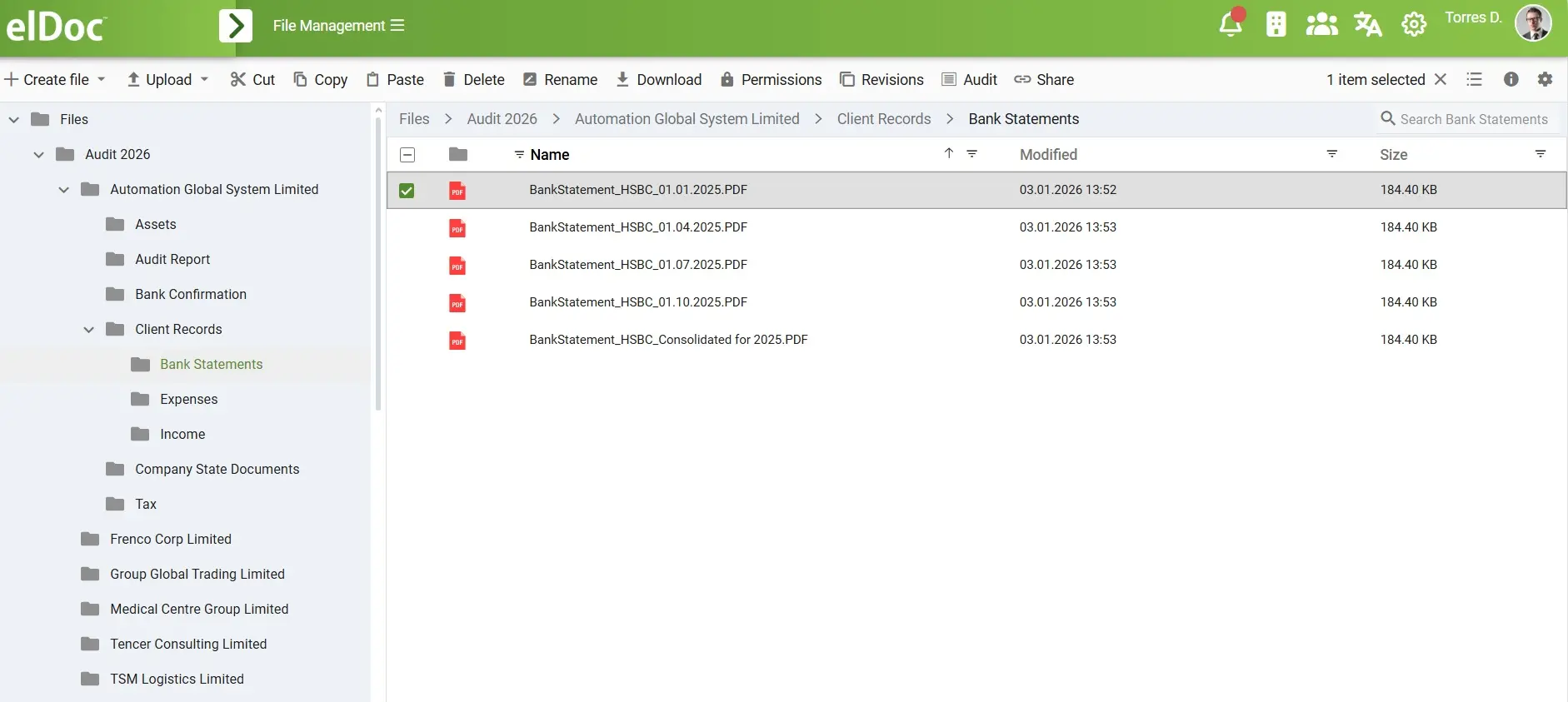

With AI-powered document classification and file organization, elDoc removes this manual burden entirely. The platform reads every uploaded document — including scans and images — understands the content rather than relying on filenames or metadata, identifies document types such as invoices, receipts, bank statements, and contracts, and organizes everything into structured, audit-ready folders.

There are no templates to configure, no rules to define, and no manual setup required. What once took days of repetitive manual effort now happens instantly and consistently.

“Audit teams begin every engagement with clean, structured, and review-ready evidence — without spending time on manual document preparation, sorting, grouping and structuring as elDoc does it all”

Challenge #2: Compliance Checks & Mismatch Detection Take Too Long

Once documents are organized, auditors enter the most time-consuming phase of the audit: analysis and validation. This is where compliance checks, policy enforcement, and cross-document verification take place — and where time pressure is usually at its highest.

Auditors must review expenses for compliance, identify policy violations, cross-check figures across invoices, bank statements, and expense reports, and detect inconsistencies or missing information. Traditionally, this work requires manual comparison across hundreds or thousands of documents, often spread across spreadsheets, PDFs, and exported reports. The process is repetitive, slow, and highly susceptible to oversight — particularly during compressed year-end timelines.

elDoc GenAI turns analysis into a conversation

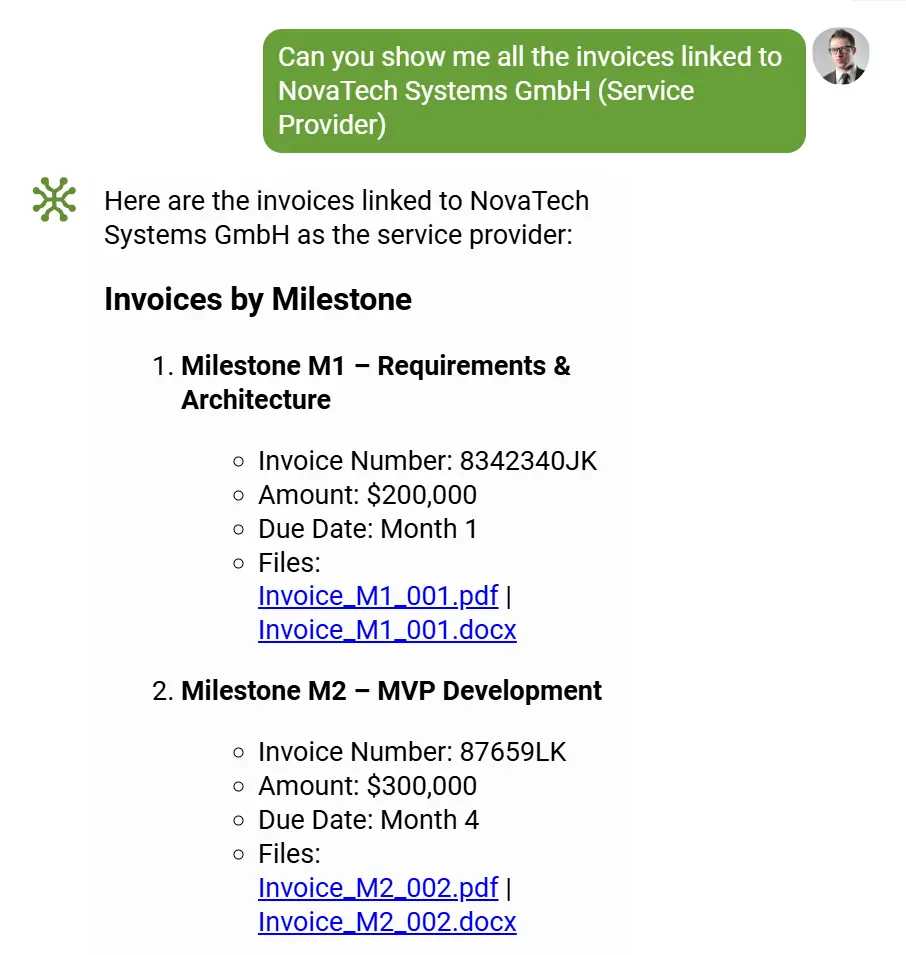

With GenAI-driven analysis, elDoc removes the need for manual searching, filtering, and cross-referencing. Auditors can interact with their audit data using natural language, simply asking questions such as “Show expenses that violate company policy,” “Find mismatches between invoices and bank statements,” or “Identify duplicate or suspicious transactions.”

The GenAI engine instantly analyzes all documents at once, cross-checks data across sources, highlights anomalies, risks, and inconsistencies, and delivers explainable, traceable results that auditors can rely on.

“Compliance reviews that once required weeks of manual comparison are completed in minutes — with broader coverage, higher accuracy, and full audit traceability.”

Challenge #3: Expense Data Capture & Balance Consolidation

Another major bottleneck in audits is expense data extraction and balance consolidation. Manually capturing data from receipts, invoices, and expense reports — and then consolidating that information into accurate balances — remains one of the most time-consuming stages of an audit. The process relies heavily on manual effort, does not scale well as document volumes grow, and often becomes a source of delay late in the audit cycle.

Manual data entry consumes valuable audit hours that should be spent on review and analysis. It also introduces transcription and classification errors, particularly when auditors are working under time pressure. As a result, balance preparation is delayed, and auditors are forced to review financial data later than planned, compressing already tight timelines.

How elDoc solves it

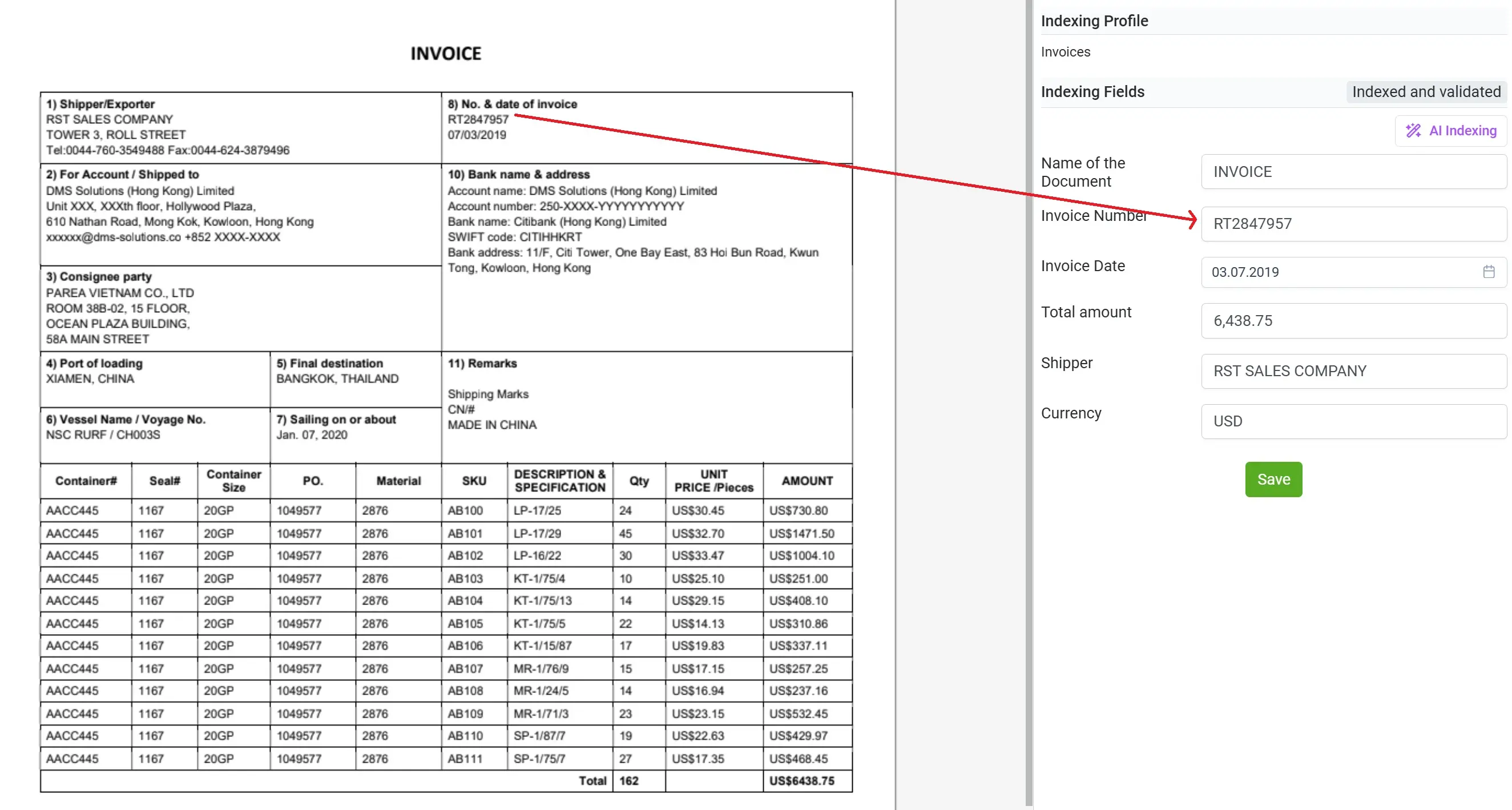

elDoc eliminates manual extraction and consolidation by applying GenAI-driven data capture across all expense-related documents. The platform reads receipts and invoices directly, extracts all relevant financial data, and automatically standardizes dates, currencies, vendors, and amounts. Instead of working with fragmented files, auditors receive a single, structured dataset that consolidates expense data across all documents.

This structured data is immediately available for validation, export into formats such as CSV, Excel, or JSON, and further AI-powered financial analysis. There is no need for manual re-keying, reconciliation across spreadsheets, or post-processing before review begins.

“Balances are prepared faster, with cleaner, standardized data — enabling earlier review and more reliable audit outcomes without manual extraction or consolidation.”

From Manual Audits to Intelligent Assurance with elDoc

Generative AI does not replace auditors — it augments them. What truly changes with elDoc is not only speed, but how audit work is performed.

By eliminating low-value administrative tasks such as document sorting, structuring, and manual data preparation, elDoc allows CPAs to reclaim their time and redirect their expertise toward what matters most: professional judgment, risk assessment, and audit quality. Auditors spend less time handling files and more time analyzing data, identifying anomalies, and forming defensible conclusions.

Beyond automation, elDoc introduces a robust and secure collaboration framework with secure file sharing designed specifically for audit engagements. Instead of exchanging sensitive information through emails or uncontrolled file-sharing tools, auditors can securely invite clients to upload required documents directly into the correct, predefined folders. Each document arrives exactly where it belongs, with full visibility, access control, and audit traceability.

Sensitive information remains protected through enterprise-grade security controls, while collaboration becomes simpler, faster, and more transparent. Clients know what to upload, where to upload it, and auditors maintain full governance over access, changes, and usage — without friction.

The result is a fundamental shift in how audits are delivered. Engagements move faster, confidence increases, and audit teams can scale their workload without increasing headcount. Manual processing gives way to intelligent assurance.

Let's get in touch

Get your free elDoc Trial and Experience the full power of GenAI

Get your questions answered or schedule a demo to see our solution in action — just drop us a message